Boom Time Again for Americas Largest Banks

Goldman leads U.s. banks in bolt trading boom

Goldman Sachs is on rail to make effectually The states$1bn in bolt trading this quarter following dramatic swings in these markets, according to sources familiar with the matter, in what would be its best three-calendar month period in commodities markets in over a decade.

The U.s. banking concern had already generated roughly United states$500m in commodities revenues before Russian federation'south invasion of Ukraine in Feb amid a notable rising in client activeness, the sources said, and its traders have connected to perform well since then.

JP Morgan and Morgan Stanley are besides set to written report strong bolt results, sources said, as corporate treasurers and institutional investors accept scrambled to position themselves for spiralling cost increases. The war in Ukraine has only served to quake these markets even further, prompting sharp moves in raw materials such as crude oil, natural gas, gold, nickel and wheat.

That high level of volatility means there is even so some uncertainty around the quarter-end revenue numbers, the sources cautioned. Spokespeople for Goldman Sachs, JP Morgan and Morgan Stanley declined to annotate.

The increase in commodities activity should help lift banks' overall trading revenues in what has been the nearly volatile period for fiscal markets since the commencement of the coronavirus pandemic. Analytics firm Coalition Greenwich projects the top 12 investment banks will written report a seven% decline in global markets revenues in the first quarter from a twelvemonth ago, though that would still correspond a more than a 35% increase from the outset quarter of 2019 (the equivalent pre-pandemic quarter).

"This is a significantly healthier markets environs for banks than before the pandemic," said Michael Turner, head of competitor analytics at Coalition Greenwich. "Although there might be some losses, the increased volatility means those volition be starting time past gains in other products. The largest banks with a wide offering should enjoy a portfolio effect."

"We're expecting [an] uptick on the G-10 macro side, with banks doing very well in commodities, and downticks in equities and credit," he added.

United states of america banks' commodity trading desks have grown in prominence since the showtime of the pandemic among heightened volatility in energy and metals markets in particular. Goldman's senior management take highlighted strong performance in commodities trading on vii of the terminal eight quarterly earnings calls as the bank has leveraged its sprawling presence beyond these markets.

Oil strength

Commodities trading caput Ed Emerson has overseen a broad-based ascension in revenues this twelvemonth across the commodities markets where Goldman is active, sources said.

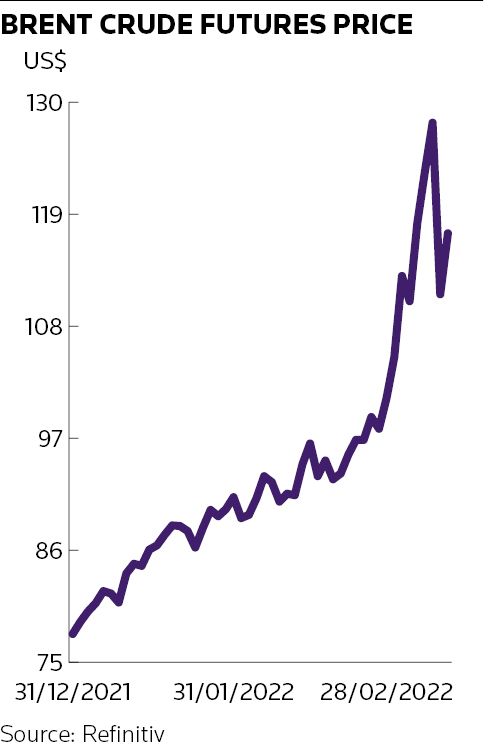

Oil trading has connected to perform well under Xiao Qin and Anthony Dewell, whose teams as well registered large gains in 2020 when oil futures prices plunged into negative territory. Brent crude oil futures contracts hit an intraday high of almost US$140 a butt on March seven – their most elevated level since 2008.

Ability and gas, which Nitin Jindal heads in N America, and metals trading have too been stiff for the bank, sources said. Prices of various precious and base of operations metals have whipsawed in recent months, with gold briefly rising in a higher place United states of america$2,000 an ounce. Elsewhere, the London Metal Exchange chose to halt nickel trading and cancel transactions after prices more than than doubled on Tuesday to over The states$100,000 a tonne.

Hedging interest

Bankers and consultants say a wider range of companies had been looking to insulate themselves against article toll moves even earlier Russian federation'due south invasion of Ukraine, given the sustained increase in costs to raw materials that they were already facing.

"I've never spoken to so many companies almost article hedging – even earlier the conflict in Ukraine started," said Amol Dhargalkar, global head of corporates at consultancy Chatham Financial. "Interest in hedging tends to be highly correlated with the commodity price cycle. Equally prices movement upwards – whether it's in metals or energy or agricultural products – companies have been scrambling to understand exposures across their organisations and supply chains, and have been looking to have a playbook to put into identify."

Uncertain times

Executives note that despite the encouraging outlook for bank trading revenues more broadly, in that location remains considerable doubtfulness over the verbal numbers. Troy Rohrbaugh, JP Morgan's head of global markets, told an investor conference on Tuesday the bank was withal on track for a x% decline in trading revenues from a twelvemonth before, but noted that a lot of clients are under "extreme stress" and "that creates potentially very significant counterparty take chances exposure".

Upwardly until late February and the Ukraine conflict, senior bankers had reported a strong trading environment for products linked to interest rates and foreign exchange in particular, as investors reshuffled exposures in anticipation of the US Federal Reserve moving to quell inflation.

That contrasts with what looks set to be a more disappointing quarter for dealmaking. Turner at Coalition Greenwich said investment banks' dealmaking revenues could fall more than than twoscore% from a year agone in the first quarter, mainly as a outcome of a sharp driblet in ECM activity and SPAC listings in particular.

"What'due south really going to hurt on the investment banking side is the lack of SPACs," said Turner.

kendrickinctureniou86.blogspot.com

Source: https://www.ifre.com/story/3283912/goldman-leads-us-banks-in-commodities-trading-boom-y3s1mvvzmt

Post a Comment for "Boom Time Again for Americas Largest Banks"